Blog: Cutting US road sector GHG emissions by 90% or more by 2050 takes both ZEVs and low-carbon fuels

Big reductions in greenhouse gas (GHG) emissions from the transportation sector are needed to limit the magnitude of climate change impacts. Understanding what kinds of policy and market dynamics are at play can help us meet national goals. Our recent study shows that there is an interplay between policy, vehicle types, and fuel sources, and that early investment in zero-emission vehicles (ZEVs) could yield big savings and big reductions in GHG emissions, by 2050. Low-carbon fuels for non-electric vehicles will also need to play an important role.

While the United States has not formally adopted long term targets for the sales of ZEVs, including battery electric, plug-in hybrid, and fuel cell vehicles, the Biden administration is a 50% sales share of light-duty ZEVs by 2030 and the US EPA has issued a proposed rule intended to slightly exceed this target.

California is leading the transition with nearly 20% ZEV market share in 2023, and with the most ambitious rules requiring a full transition of LDV sales to ZEV by 2035 and trucks to ZEV by 2040. Many states are following. So far, 16 states have committed to adopting the California LDV ZEV program, and at least 16 have signed the Multi-State Medium- and Heavy-Duty Zero Emission Vehicle MOU. If the Biden administration adopts the CO2 rules as currently drafted all 50 state vehicle markets will be required to move in the same direction. It then seems likely that most states will achieve 100% ZEV sales by 2045, 10 years after California’s target.

We recently published a major report on transitioning the US to ZEVs, along with other steps to achieve a very low carbon road-transport sector in the US by 2050. Our report considers a range of scenarios based on vehicle market and policy trends, extending trajectories to 2050. In each case, overall GHG emissions reductions are achieved sooner with the adoption of low-carbon fuels such as advanced biofuels. Our results show that it is possible to reach a 90% or greater reduction in road GHG emissions by 2050 compared to 2015, even in our slowest ZEV transition scenario.

Major findings include:

- Fast ZEV uptake works but is challenging. Our Low Carbon California (LC CA) scenario is the most ambitious, reaching 100% ZEV sales nationwide by 2035, and 90% ZEV stock by 2050. It involves achieving 68% and 51% of ZEV sales by 2030 for LDVs and trucks, respectively, which will be challenging over the coming seven years.

- Very high uptake of low-carbon fuels is another, complementary option. Our Low Carbon 10-to-15-year (LC 10-15) scenario is the least ambitious for ZEV uptake and therefore requires the most liquid fuels to reach a 90% GHG reduction. It does not reach 100% ZEV sales nationwide until 2050, resulting in about 54% ZEV stock in that year. These, along with a high uptake of low-carbon fuels in remaining ICE vehicles, achieves an overall GHG reduction of 90% in 2050.

- Low GHG electricity and hydrogen are critical for both types of scenarios. All ZEVs must eventually be powered from these energy sources, with the electricity and hydrogen providing net zero carbon energy hopefully well before 2050.

- The slower the ZEV uptake, the more challenging the biofuels component. The result of slower ZEV uptake is a build-up to very high—possibly infeasible or unsustainable—levels of advanced, very low-carbon biofuel use to ensure ongoing GHG reductions in the transportation energy sector. A transition will be needed from today’s dominant grain and oil-based biofuels to predominantly cellulosic biomass-based fuels to maximize their GHG benefits.

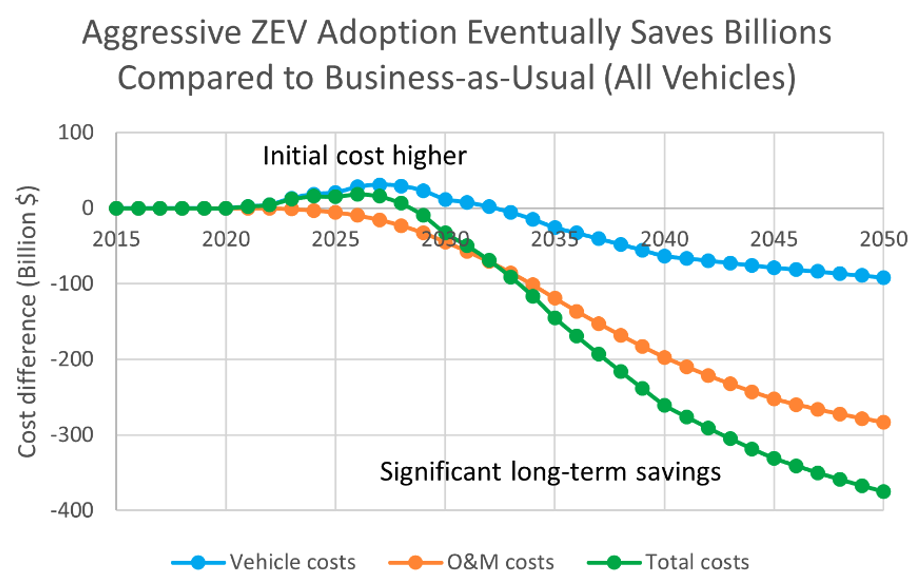

- All scenarios save money, but ZEVs are likely to be cheaper than low-carbon fuels. Cumulative costs of the alternative scenarios from 2020 to 2050, aggregated across LDVs and trucks, are much lower than the business-as-usual (BAU) scenario. The faster the ZEV transition, the greater the net savings between now and 2050. This is mainly due to the lower need for maintenance and higher fuel efficiency of ZEVs. As ZEV prices fall over time, savings on vehicle costs of the alternative scenarios also contribute to overall savings. However, for some specific vehicle types, such as long-haul (LH) trucks that are dominated by fuel cell vehicles (FCV) with only a modest increase in fuel economy over diesel trucks, there are no fuel cost savings, so overall costs are higher than the BAU scenario.

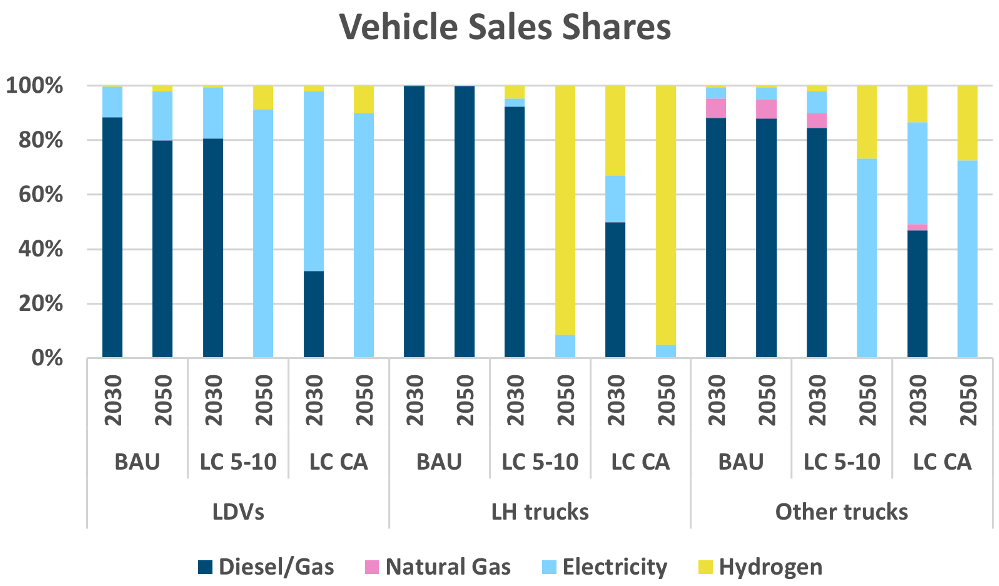

Our analysis also evaluates battery electric energy vs. hydrogen fuel cells for 10 different vehicle types, including LDVs, trucks and buses of different sizes and types. The general results are shown here, with sales shares varying by vehicle type and year for our BAU and two fastest transition scenarios. Our background technology analysis shows that electric vehicles dominate LDV and most truck sales by 2035. However, for long haul trucks, we find hydrogen fuel cell trucks eventually could dominate. In any case, the ZEV sales share is 100% by 2050 in all our scenarios except the BAU.

Comparing the fastest transition (LC CA) to BAU for costs, including purchase, fuels, and maintenance costs of all vehicles, we find that this scenario is more expensive than BAU until around 2030, then has lower net costs, becoming much lower very quickly. These higher “investment” costs pay off with around 54 times the savings after 2028 in a non-cost discounted scenario. Slower ZEV transition scenarios save less money, since it’s the ZEVs—particularly battery electric vehicles—that save money, while biofuels costs are generally higher than fossil fuels.

As our report describes, there are many details that are uncertain. Continuing research will be needed to better predict outcomes. For example, costs may change over time in unpredictable ways, and will depend to a large degree on scaling and learning. The level of policy support that may be needed to help manage the costs of transition are uncertain. The net societal costs of various types of policies and/or regulatory strategies are important, though often difficult to estimate. Our research over the coming one to two years will focus on better understanding fleet behavior, non-cost decision factors, electricity costs, and the potential role, sourcing, and costs of advanced biofuels as well as e-fuels.